Corporate Tax Returns in the UAE : Fulfilling corporate tax obligations is mandatory for businesses operating in the UAE to comply with local regulations. Neglecting to file tax returns within the specified timeframe can lead to financial penalties. The UAE government, through the Federal Tax Authority (FTA), mandates the timely submission of corporate tax returns.

In January 2022, the Ministry of Finance in the UAE introduced corporate tax legislation, with implementation slated for either June 2023 or January 2024. Effective June 1, 2023, the law imposes a 9% headline tax rate, while companies with annual taxable profits below AED 375,000 are exempt from taxation. This tax framework aligns with international best practices.

Under this system, all taxable entities must register for corporate tax and obtain a unique Tax Registration Number (TRN). In specific cases, even exempt entities may be required to register for corporate tax at the discretion of tax authorities.

Understanding Corporate Tax Return Filing in the UAE

Corporate tax return filing in the United Arab Emirates (UAE) involves submitting a comprehensive report to the pertinent tax authority outlining a company’s income and expenditures. This Corporate Tax Return is filed by the Taxable Person for a defined tax period, detailing corporate tax liability and payment information. Compliance with the Corporate Tax Law mandates the submission of the Tax Return within a specified timeframe to the tax authority.

Should the tax authority request supplementary information, documents, or records, it is incumbent upon the taxpayer to furnish these to the tax authority.

Is Filing Corporate Tax Returns Mandatory in the UAE?

Indeed, filing corporate tax returns is compulsory in the United Arab Emirates (UAE). The Federal Tax Authority (FTA) mandates that companies functioning within the UAE submit tax returns and settle taxes based on their taxable earnings in accordance with UAE tax regulations. Nevertheless, businesses with an income below AED 375,000 are subject to a 0% tax rate.

These tax regulations are applicable to both domestic and international enterprises operating in the UAE. Non-compliance, such as neglecting to file tax returns or failing to pay taxes, may lead to penalties and fines

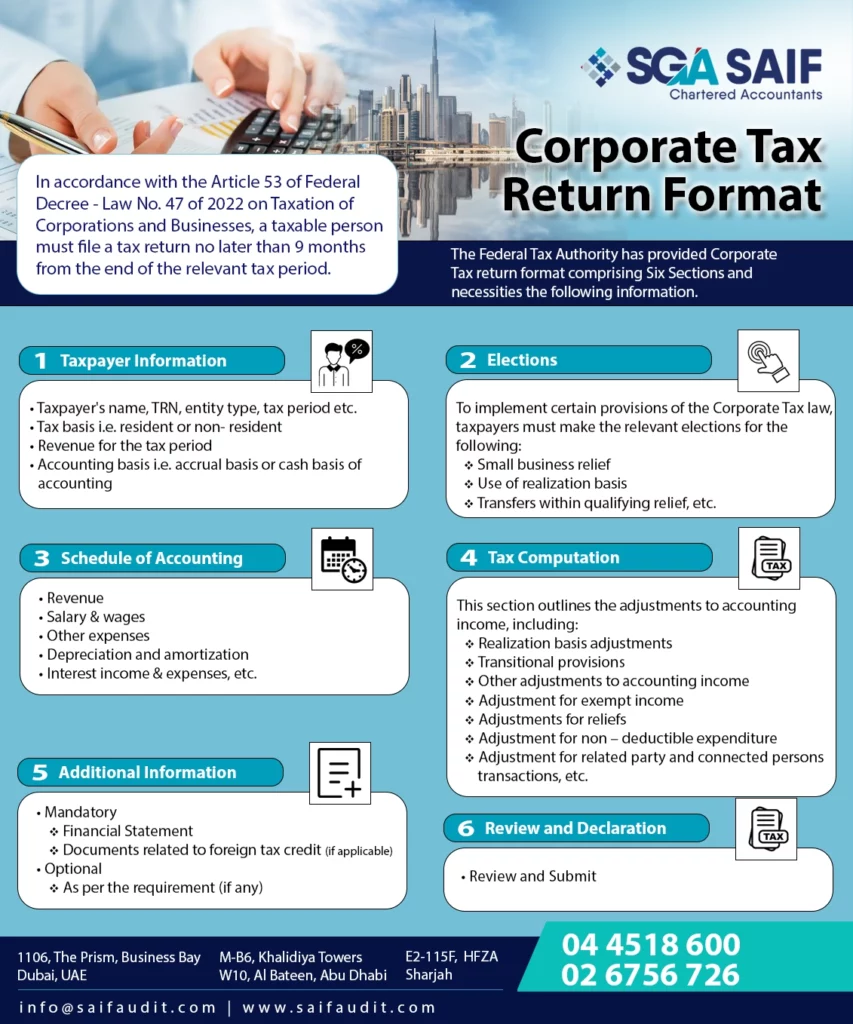

Corporate Tax Return Format

After much anticipation, the corporate tax return format has finally been released, featuring six comprehensive sections tailored to meet your tax filing needs:

- Taxpayer Information: Provide accurate and complete details about the taxpayer to ensure smooth processing of the tax return.

- Elections: Make necessary elections as per your business requirements to optimize your tax filing process.

- Schedule of Accounting: Present a clear and organized schedule of your accounting activities to facilitate efficient tax assessment.

- Tax Computation: Compute your taxes accurately, adhering to the guidelines specified in the tax return format.

- Additional Information: Include any supplementary details or documentation required to support your tax return filing.

- Review and Declaration: Thoroughly review the information provided in all sections before making a declaration and submitting your tax return to the Federal Tax Authority (FTA).

Remember, it’s essential to fill out each section correctly and completely to ensure compliance with tax regulations and avoid any potential issues. Don’t forget to submit your tax return to the FTA within the stipulated timeframe.

Stay tuned for further updates and guidelines regarding corporate tax filing on our website. If you have any questions or need assistance with your tax return, feel free to reach out to us. We’re here to help you navigate through the process seamlessly.

Recent Comments