UAE Corporate Tax Registration : As per the latest update from the Federal Tax Authority (FTA), certain companies and entities can now begin the UAE corporate tax per-registration process. If your business falls under the scope of this notification, it’s mandatory to register for UAE corporate tax following the FTA’s guidance. Keep in mind that this is an early registration requirement, and you should assess whether your business needs to register now or later.

Which Businesses Must Register for Corporate Tax in the UAE?

The FTA requires all taxable persons (both legal and natural) to register for corporate tax (‘CT’) and obtain a Tax Registration Number.

| Legal Persons | Natural Persons |

| UAE Public Joint Stock Company | Individual |

| UAE Private Company (incl. an Establishment) | Sole Proprietorship/Establishment or Civil Company |

| UAE Partnership | Partner in a Partnership |

| Foreign Company Club or Association or Society | Other |

| Trust, Charity, Foundation, Federal Government Entity, Emirate Government Entity. |

UAE Corporate Tax: Registration Time Line

What is the registration timeline for Corporate Tax in the UAE for businesses with a financial year of January 1st to December 31st?

According to the FTA website, taxable individuals have until their first tax filing date to register. For instance, those with a year ending on 31 May have 26 months to register (until 28 February 2025), while those with a financial year ending on 31 December have 33 months (until 30 September 2025) to register.

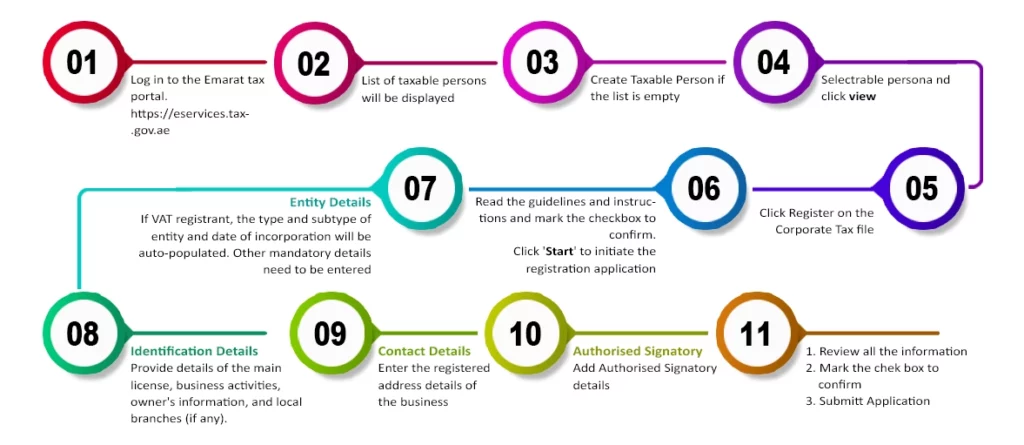

Steps to Register for UAE Corporate Tax: A Comprehensive Guide on Emaratax

FTA has released a User Manual containing guidelines and instructions to navigate through the EmaraTax portal.

Here’s an Overview of UAE Corporate Tax Registration.

UAE Corporate Tax Registration User Manual | How and When to Register ?

Recent Comments