Dubai virtual company licence, costs Dh850

Dubai virtual company licence is granted without a residence visa

Dubai Virtual Company License: Dubai launched a virtual company licence which will cost Dh850 for a year.

The virtual license costs Dh850 ($233) for one year which includes a Dh200 startup fee for sole proprietorship and Dh650 for the licence. While a two-year licence will cost $411 (Dh1,508) and $589 (Dh2,161) for three years.

Virtual companies are registered in Dubai to individuals who don’t reside in the UAE and the owner of the companies must be nationals or tax residents of certain countries.

Residents of around 120 countries can obtain the virtual commercial license with whom the UAE has signed double-taxation avoidance agreements.

The emirate aims to have 100,000 companies in the virtual city. However, the licence will not automatically guarantee physical access to the UAE – be it in the form of a business or visitor or resident visa to any of the company’s partners or employees.

The licence is allowed to undertake selected professional activities including services related to

- printing and advertising

- computer programming

- consultancy, and related activities

- design activities.

Virtual Company Licence’ for non-resident business people and freelancers

Virtual Company Licence will allow investors worldwide to do business in Dubai digitally

Who is the licence for?

The Virtual Company Licence, a joint initiative of Dubai Economy, Dubai International Financial Centre (DIFC), General Directorate of Residency & Foreigners’ Affairs (GDRFA), Smart Dubai, and the Supreme Legislation Committee, focuses on three main sectors: creative industries, technology and services.

The initiative, which offers vast opportunities for investors around the world to work digitally in Dubai without having to be in Dubai, will enhance confidence among businesses and investors while also opening new horizons for business competitiveness and growth in Dubai and the UAE.

Verified non-residents

The programme allows only verified non-resident individuals to register a company, and the owners of such companies have to be the nationals or tax residents of countries that have implemented the Convention on Mutual Administrative Assistance in Tax Matters and share tax information about their citizens and residents

Eligible countries

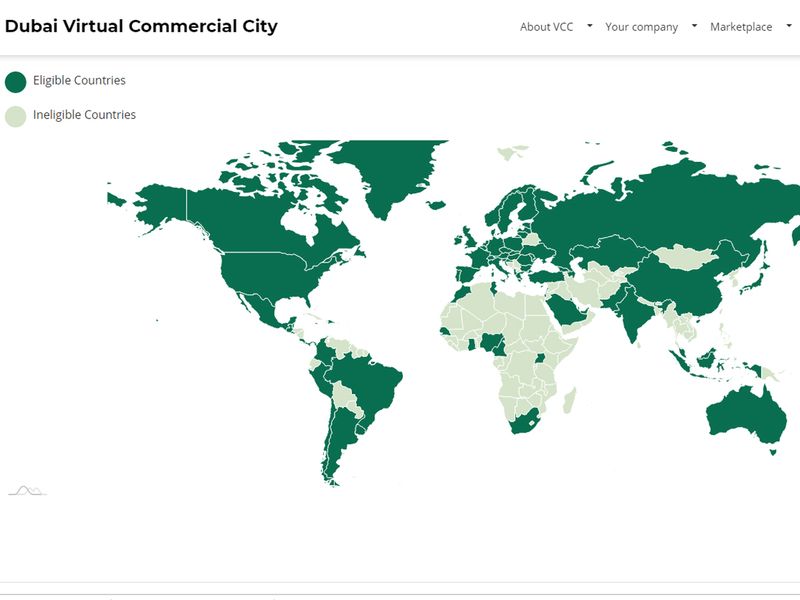

The official website has a heatmap showing the eligible and non-eligible countries across the globe. India, Pakistan, Saudi Arabia, China, Russia, North Americas, South Africa, Nigeria, Cameroon, Uganda, Brazil, Argentina, Chile are some of the countries on the eligible list. Yemen, Oman, Sri Lanka, Thailand, Venezuela, Algeria, Egypt are on the non-eligible list according to the map online.

How to apply

Dubai Economy will start receiving applications for the Virtual Company Licence from businessmen and investors in 101 countries through the website www.vccdubai.ae or through the offices of VFS Global across 11 locations worldwide. VFS Global, headquartered in Dubai, is the world’s largest technology services specialist for governments and diplomatic missions worldwide. The initiative is expected to attract more than 100,000 companies and offer new opportunities for innovators and local companies, accelerating economic activity and the knowledge economy in Dubai.

Dubai Virtual Company Licence : How do I qualify?

The establishment of a virtual company in Dubai is suitable for legitimate business interests only.

- Virtual companies are registered in Dubai to individuals who do not reside in the UAE.

- The owners of virtual companies must be the nationals or tax residents of approved countries.

- Virtual companies can conduct location-independent business activities globally in pre-defined sectors.

- Virtual companies remain subject to corporate, individual income and social taxation in the country of incorporation and/or residence, depending on the location of economic activities and international tax agreements.

- Virtual companies operate in a transparent manner including a full public registry of the names of the owners, which will be shared with the tax authorities of relevant jurisdictions upon request.

- A Virtual Company License does not automatically guarantee physical access to the UAE be it in the form of a business or visitor or resident visa to any of the company’s partners, directors or employees. However, Dubai Government authorities are working on a simplified visa process for the holders of Virtual Company License.

- A Virtual Company License does not automatically guarantee a business bank account in the UAE. Bank account opening will be at the discretion of commercial banks. However, we can facilitate access to account opening processes.

- All applicants for a Virtual Company License are subject to background checks by Dubai Government authorities.

- Virtual companies that have the legal form of a sole proprietorshipare not subject to local ownership, director, auditor, or qualified business service provider requirement.

- Tax registration with UAE’s Federal Tax Authority is required if the company’s revenue within the UAE exceeds USD 100,000 per annum. Tax registration is the obligation of the virtual companies. Value added tax (VAT) in the UAE is 5%, there is no income taxes on non-financial entities.

- Dubai Government has instituted measures against money laundering and tax evasion in line with international agreements and conventions that the UAE is party to.

Credit : https://vccdubai.ae, Gulf News

Recent Comments